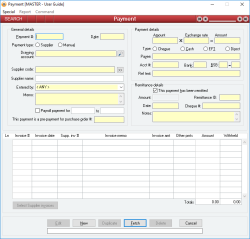

Payment

A Payment is the means by which amounts are paid to your Suppliers: it represents a physical financial transfer of an amount of money.

A Payment can be a Supplier Payment, created for a specific Supplier (and therefore allocating a single amount to their account) and allocated to one or more Supplier invoices for that Supplier. Only Supplier invoices for the specified Supplier can be allocated an amount.

A Payment can also be a Manual Payment, distributing amounts to one or more allocation accounts, such as Expense or Cost of Sales accounts.

Regardless of whether or not a Payment is a Supplier Payment or a Manual Payment, the total amount of the payment is taken from the Drawing account of the payment (usually a bank or overdraft account).

A Payment can automatically withhold amounts of tax that relate to Supplier invoice with no ABN or for Suppliers who have a voluntary withholding agreement in place (see Voluntary Withholding % in Suppliers s). The Payment amount for a Supplier invoice is the total amount that your enterprise no longer owes the Supplier, whereas the Amount remitted is the amount actually paid to the Supplier, and does not include the Withheld amount (this is remitted to the tax office as withholding tax).

- If you have allocated a larger amount to a Supplier invoice than you owe for that Supplier invoice, you will be informed of this and will be unable to update the Payment

- If you are editing an existing Payment and the Payment amount or the Amount remitted has changed, you will be warned and asked if you want to continue with the update. If you select No, then you will be returned to Edit mode and no further action will take place.

- For a Supplier Payment, If you have not allocated all of the Payment amount to Supplier invoices then you will be warned of this and asked if you want to continue. If you select No, then you will be returned to Edit mode and no further action will take place.

- If the Supplier invoice is a Manual Payment, then for every line having a valid Account code and a non-zero amount a single PAYMENT Journal transaction is created that Debits the account code account for the line and Credits the Drawing account by the total amount of the line.

- If the Supplier invoice is a Supplier Payment, then a single PAYMENT Journal transaction is created that Debits the Supplier’s account and Credits the Drawing account by the total Amount remitted for the Supplier invoice. Then, a single PAYMENT Journal transaction is created that Debits the Supplier’s account and Credits the Supplier withholding account (specified in the Database Setup) by the total Amount withheld for the Supplier invoice.

- If the Supplier for the payment has been marked to automatically email remittance advice and a valid remittance email address has been specified for the supplier, then the user will be prompted as to whether remittance advice should be emailed if the payment is moving from a non-remitted to a remitted state.

- Amounts are automatically withheld for Supplier invoices without an ABN or for Suppliers who have a voluntary withholding amount specified

- Manual payments can be taken from a single account and distributed to an unlimited number of allocation accounts

- Supports computer printed cheques or electronic payment details

- Payments may be edited after their creation, but a warning is issued if the amount has changed

- The total of amounts allocated to Supplier invoices for a Payment do not have to equal the Payment amount, but if not a warning will be issued

- Pop up notifications available for Suppliers and Items

- Records from previous financial years can be added, edited and deleted

- Search results that have the same value for the sorted field will be sorted secondly by the payment date

Last edit 28/10/20

Module: Accounts payable

Category: Payments

Activation: Main > Accounts payable > Payment

Form style: Multiple instance, WYSIWYS, SODA

Special actions available for users with Administrator permissions:

- Use the Void All Remittances option from the Special menu.

- Alter the User ID in the Entered by field.

- Override Hold Payment check on Supplier invoice.

- Override warning where the Payment Amount differs from Supplier invoice Totals.

- Void Remittance status, change Cheque # / Remittance #, and override warning regarding change in Remittance Amount.

- View and edit Payroll payments.

- Change the User ID of the Entered by field of memos.

- Edit memos entered by other users.

Database rules:

- You cannot allocate an amount to a Supplier invoice that exceeds the amount owing for that Supplier invoice

- A Payment cannot be given a date that is outside the range of the Extended financial year

- A Payment cannot be deleted if its date is outside the range of the Extended financial year or before the Journal lock date

Reference: Select from list, Mandatory, WYSIWYS

This is the type of payment as follows:

- Supplier: A Supplier Payment is a payment made specifically to a supplier (and therefore allocated only to the Supplier’s account) and is the only way to allocate amounts to Supplier invoices for that Suppliers

- Manual: A Manual payment is a payment made that can be arbitrarily allocated to one or more General ledger accounts instead of a Creditor. This type of payment is made where a Supplier invoice does not exist and where the payment is made immediately. For example, bank fees and charges would be a manual payment allocated directly to one or more expense accounts. Alternatively, a wages payment from the Payroll system is a manual payment from a bank account and allocated to a wages suspense account

If a Creditor payment is selected, you will be presented with Payment lines showing Supplier invoice allocation information. If a Manual payment is selected, the Supplier invoice lines display account allocation information.

Once the type of a Payment has been selected, it cannot be changed in subsequent edits of the record.

Reference: Account Field Type, Mandatory, QuickList, WYSIWYS

This is the account from which the amount of the Payment is drawn. This would usually be a bank account (asset) or overdraft account (liability), but could be a cash on hand account such as Petty Cash.

The currency of the Drawing account you enter will form half of the basis for determining whether the Payment is a multi-currency Payment. For a Supplier payment, the other determining factor will be the currency in which the Supplier invoice you enter are completed. For a Manual payment the decision will be based on the currency of the accounts entered on the Payment lines.

Reference: Text(12), Mandatory, AutoComplete, QuickList, WYSIWYS

This is the Supplier code that represents the supplier to whom the amount is being paid. This field is an auto-complete field and must contain a valid supplier code before you can update the Payment. To display a list of all valid supplier codes, click on the button or press the QuickList Hot Key. You will not be able to enter the code of any supplier whose account has been closed.

This field will only be visible if your have selected a Payment type of Supplier. It is used to determine the supplier account to which to allocate the amount of the payment.

Once a valid supplier creditor code is selected, you may only allocate supplier invoices in the Payment lines section that are associated with the selected supplier.

Note: The Supplier code and name fields will not display if the Payment Type "Manual" is selected.

Reference: Text(64), AutoComplete, QuickList, WYSIWYS

Note: The Job code and Job name fields will only display when the Payment Type "Manual" is selected.

Reference: Select from list, HotEdit, WYSIWYS

Information is under review for a new version and will be updated soon.

This option allows you to allocate a payment for a range of Purchase orders. When you select this checkbox, you are not able to allocate this payment as a prepayment for a Purchase order.

Last edit 19/09/19

Reference: Number, QuickList, WYSIWYS

This field is not visible when the "Payroll payment for" checkbox has been selected.

Last edit 19/09/19

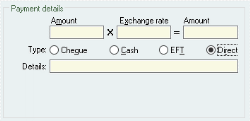

Reference: Currency, Mandatory, WYSIWYS

This is the total amount of the Payment, but not necessarily the actual amount remitted to a Suppliers (see below).

If the Payment type is Supplier, this is the total amount of the Payment that is being allocated to the Supplier’s account and therefore the amount by which your debt to that Supplier is reduced. However, the actual amount drawn from the Drawing account will only be that portion of the payment that is not being withheld from the Supplier (because one or more Supplier invoices have no ABN or the Supplier has a voluntary withholding amount). The Withheld amount is also allocated to the Supplier’s account, but it is taken from the Supplier withholding account (defined in the Database Setup) instead of the Drawing account. The effect of this is that legally, you have paid the entire amount owing to the Supplier, but physically you remitted part of the amount to the supplier and the rest (eventually) to the tax office.

If the Payment type is Manual, this is the total amount that is being drawn from the Drawing account and allocated to allocation accounts shown in the Payment lines.

If the Payment amount is left blank when updating a single currency payment, it will be automatically filled in with the payment total.

The Payment amount should always be specified in terms of the currency displayed next to it. This currency is determined by the currency of the Drawing account.

Reference: Currency, Mandatory, WYSIWYS

This is the exchange rate given at the time the payment was completed.

This field will only be visible if the currency for the Drawing account differs from the currency of the Payment lines accounts (Manual payment) or Supplier invoices (Supplier payment).

When an exchange rate is entered, both it and the Amount are used to calculate the corresponding amount for the second currency.

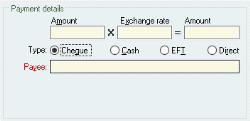

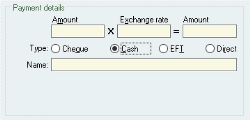

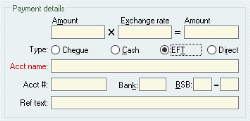

Reference: Select from list, Mandatory, WYSIWYS

This selects the method by which remittance occurs. Only a user with Administrator permissions for Payments can change the type during an Edit of an existing Payment. The type must be one of the following:

EFT

EFT details will be automatically filled when the EFT payment type is selected. This only occurs if it is a new payment or all EFT payment fields are empty.

Ref Text

This is the EFT reference text that will be used when creating an automated remittance ABA data file. The field is automatically filled in when entering a payment based on either the system wide EFT reference text of the selected suppliers reference text. Once filled, the user can then modify the field manually if required.

Direct

The Amount remitted is being transferred electronically using the direct transfer details appearing below. The Payment form does not perform the electronic transfer.

Reference: Currency, Read-only

This is the cheque, direct debit or cash amount actually remitted.

If the Payment type is Manual, this amount will be the same as the Payment Amount.

If the Payment type is Creditor, this amount will be the Payment amount less the Withheld amount.

Reference: Number, Read-only, WYSIWYS

This is the remittance ID that was generated by the automated remittance form when this payment was remitted. This value was automatically stored for this payment upon automated remittance and is useful for searching purposes.

Clicking on this field while the form is in Idle mode will take you directly to relevant Remittance record.

Reference: Date, QuickList, WYSIWYS

This is the date that remittance was completed for this payment. This date can be filled either by remitting the payment with the automated remittance form, in which case the date is automatically stored for this payment upon automated remittance, or the date can be entered manually. If you choose to enter a remittance date manually and the remittance type is set to Cheque, then a cheque number must also be entered before the payment can be updated.

This is the cheque number of the cheque issued for the Amount remitted if the remittance method is Cheque and is not applicable for any other remittance method.

Only a user with Administrator permissions for Payments can change the Cheque # during an Edit of an existing Payment.

Reference: Memo, Expandable, WYSIWYS

This is free-form text containing any remittance notes relevant to the Payment.

Reference: Number, QuickList, WYSIWYS

This is the Supplier invoice number for this line and is only visible if the Payment type is Supplier. You won’t be able to enter a number in this field until you have entered a valid Suppliers for the Payment.

You cannot update a Payment that contains duplicated Supplier invoice numbers in its lines, and any Supplier invoice number you enter in this field must be a valid Supplier invoice for the Supplier you have selected.

After you have typed in a Supplier invoice number in this field, the other columns of the Payment line will be automatically filled in with the appropriate values for that Supplier invoice.

You can select Supplier invoices by either using the QuickList Hot Key or by clicking on the Select Supplier invoices button. You are able to select multiple Supplier invoices at a time using this method.

The currency of the Supplier invoices you enter in the Payment lines will form half of the basis for determining whether the Payment is a multi-currency Payment. The other determining factor will be the Drawing account for the payment.

This is the date of the selected Supplier invoice for the line and is only visible if the Payment type is Creditor payment.

Information is under review for a new version and will be updated soon.

This is the memo entered on the selected Supplier invoice and is only visible if the Payment type is Creditor payment.

Reference: Currency, Read-only

This is the total amount of the selected Supplier invoice and is only visible if the Payment type is Creditor payment.

Reference: Currency, Read-only

This is the amount that has already been paid off the selected Supplier invoice by other Payments, and does not include the amount entered for the current Payment. This field is only visible if the Payment type is Creditor payment.

Reference: Currency

This is the amount that is being allocated for this Payment line. If the Payment type is Supplier, this amount is the amount allocated to the Supplier invoice and cannot be more than the amount currently owing for the Supplier invoice.

If the Payment type is Manual, this amount is the amount being allocated to the specified Payment line account.

Reference: Currency, Read-only

This is the amount that will be withheld from remittance because either the Supplier invoice has no ABN or because the Creditor has a non-zero Voluntary withholding % set up for them. The withholding percentage used is the greater of the No ABN withholding % and the Creditor’s Voluntary withholding %.

This field is only applicable if the Payment type is Creditor payment

Reference: Button

This button activates the Supplier invoice Quicklist that displays a list of all unpaid Supplier invoices from which you can select. You can select multiple Supplier invoices using this method.

Reference: Account Field Type, Mandatory, QuickList

This field is the account code to which the amount for this Payment line is allocated and will only be visible if the Payment type is Manual.

This can be any valid account code and any account type, but it would generally be an expense or cost of sales account.

The currency of the first account you enter in the Payment lines will form half of the basis for determining whether the Payment is a multi-currency Payment. The other determining factor will be the Drawing account for the payment.

This is the account name corresponding to the selected Account code and will only be visible if the Payment type is Manual.

If the corresponding account code field does not contain a valid account code, this field will display *** INVALID ACCOUNT ***.

This is the description or reason for the allocation and will only be visible if the Payment type is Manual. Because this is for a manual payment line that is not referenced back to a Supplier invoice, it is important that a meaningful reason or description of the allocation is entered.

Reference: Menu

This menu option clears the Remittance ID and the Remittance date from the current Payment. Voiding a remittance removes any information relating to the fact that the Payment has actually been made.

You can manually void a remittance by editing the Payment and clearing the remittance date, providing the payment was not remitted using the automated remittance system. In this case, you must void the remittance Id using this method or the Void All Remittances method.

Before the remittance is voided, you will be asked to confirm that this is really what you want to do.

You would typically void the remittance for one or more payments if further processing of the remittances failed (for example an electronic transfer to your bank failed or a printer / paper error caused cheques to be misprinted). After voiding a remittance for a payment, the payment may be remitted again in the usual manner.

Reference: Menu

This menu option clears the Remittance ID and the remittance date from all Payments that were remitted using the automated remittance system and which correspond to a nominated Remittance ID. Voiding a remittance removes any information relating to the fact that the Payment has actually been made.

When you select this option, you will be asked to enter a Remittance ID. When you click the OK button, the remittance information for all Payments remitted under this Remittance ID will be cleared.

You would typically void the remittance for one or more payments if further processing of the remittances failed (for example an electronic transfer to your bank failed or a printer / paper error caused cheques to be misprinted). After voiding a remittance for a payment, the payment may be remitted again in the usual manner.

Reference: Menu

This menu option emails remittance notification to the relevant supplier, providing an accounts email address exists for the supplier.

Reference: Menu

Information is under review for a new version and will be updated soon.

Reference: Menu

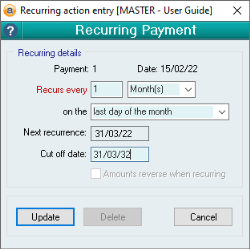

This menu item allows you to set the payment to recur at specified periods, such as if it represents a monthly bill.

Selecting this option will open the Recurring Payment form shown below and allows you to enter the following details.

Reference: Select from list

This option is only available for the Recurring Journal Entry form.

This option allows you to select one of two Journal entry types:

- Normal: This option means that the Recurring Journal Entry will function the same as all other recurring actions.

- Accrual: This option means that the journal will become a reversing journal that will happen once only, will recur on the 1st day of the next month, and will reverse the amounts of the original journal.

Reference: Read only

This field is read-only and displays the type and code to which the recurring action refers. The four types of recurring actions are:

- Journal entry: This recurring action is triggered from the Special menu of the Manual journal entries form and will display the Journal entry #.

- Sales invoice: This recurring action is triggered from the Special menu of the Sales invoice form and will display the Sales Invoice #.

- Supplier invoice: This recurring action is triggered from the Special menu of the Supplier invoice form and will display the Supplier Invoice #.

- Payment: This recurring action is triggered from the Special menu of the Payment form and will display the Payment #.

Reference: Read only

This field is read-only and displays Date for the selected record referenced in the Recurring info.

Reference: Number, Select from list

This field allows you to specify the number and unit by which you want the action to recur. The quantity field can be filled with any number up to 4 digits long. The unit field allows you to choose one of:

- Day(s)

- Month(s)

- Year(s)

Reference: Select from list

This field allows you to choose when in the given month the action will recur. This field is only available when Month(s) or Year(s) have been selected in the Recurs every... field. The options are:

- Day specified

- First day of the month

- First weekday of the month

- Last day of the month

- Last weekday of the month

Reference: Read only

This field is a read-only date displaying when the recurring action will next occur, as calculated by the selections in the Recurs every... and ...on the... fields.

Reference: Date

This field allows you to specify when you would like the recurring action to cease.

Note: If you input a date into this field that occurs before the Next recurrence date, this action will not recur.

Reference: Yes/No

This option is only available for the Recurring Journal Entry form.

This option allows you to specify that the amounts on the recurring journal entry will reverse the current journal entry. This is selected by default when the recurring entry type is set to Accrual.

Reference: Button

There are three buttons at the bottom of the Recurring action form, which are:

- Update: This will update your changes to the recurring action (either for a new entry or on an existing one).

- Delete: This will delete the existing recurring action.

- Cancel: This will cancel your changes.

Reference: Menu

Information is under review for a new version and will be updated soon.